Why Can't You and I Get Rich Quick?

even smart progressive people understate how hard it is to get rich quick

People like us can’t get rich quick; in fact we probably can’t get rich at all. This is not some crazed Marxist ranting, but rather an informed perspective on the American economy and who it rewards. Let me illustrate. First, the easy way.

Be Born Into a Wealthy Family

A lot of center-to-right types love to gnash their teeth over this, but it’s simply true that most wealthy Americans were born into families of above-average means. There’s mountains of data on this, entire books you can read about the persistence of economic privilege. (The Son Also Rises by Gregory Clark is particularly sobering in this regard.) To pick a few data points, a 2022 study found that only 27% of surveyed multimillionaires claimed to be self-made, and this likely overstates because the self-reporting bias would tend to lead people to claim that they are self-made when they aren’t. One of Raj Chetty’s papers found that, as 538 summarized, “rich kids stay rich, poor kids stay poor.” According to a 2019 Georgetown study, discussed here by CNBC

… a kindergarten student from the bottom 25% of socioeconomic status with test scores from the top 25% of students has a 31% chance of earning a college education and working a job that pays at least $35,000 by the time they are 25, and at least $45,000 by the time they are 35.

A kindergarten student from the top 25% of socioeconomic status with test scores from the bottom 25% of students had a 71% chance of achieving the same milestones.

Parents who are homeowners, naturally, are more likely to have children who will become homeowners, even exclusive of homes passed down via inheritance. Meanwhile, two-thirds of various tax subsidies related to homeownership and retirement go to the top 20 percent of earners, which means that public policy helps families who already have wealth pass that wealth on to their children. As I said, I could pull a lot more data like this. Now, because I’m me, I would point out that because academic ability is heritable and academic ability is moderately to strongly correlated with financial success, it wouldn’t be correct in a simplistic sense to suggest that this means that the persistence of family wealth is random or independent of the ability of the individual. There’s a whole big conversation about the ethics and fairness of inherited wealth. But, for our purposes here, it doesn’t really matter - summatively, we know that the easiest way to ensure that you’re rich is to be born rich. We can argue about what it all means and what the public policy response should be, but I don’t know how any honest person could claim that they would rather be born poor than wealthy for the purposes of securing a better financial future. Unfortunately, you can’t choose what family you’re born into. Paging John Rawls.

Next, the realistic path to (relative) wealth.

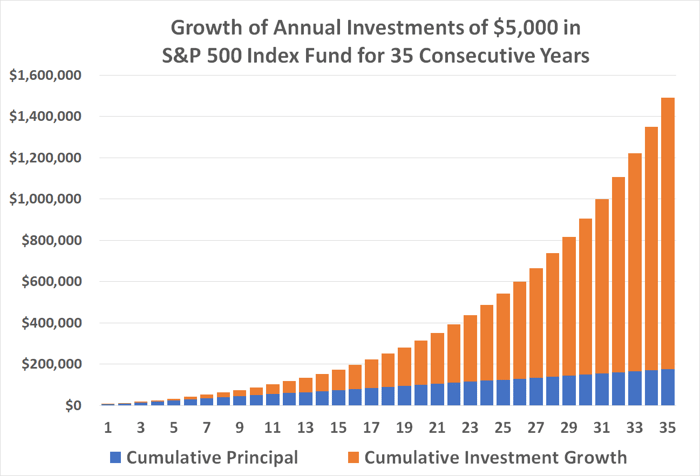

Earn a degree in a solidly remunerative field, be willing to periodically change employers over the course of your career to increase earnings, make more than you spend, stick 12ish% of each check into an index fund, retire with a million or two.

This is the one that a lot of people can do. I wish I could say that everyone could do it, but as you know, I believe that not everyone has the same skills, abilities, or temperament, and this forecloses on professional possibility. Unfortunately, not everybody is suited for a good solid middle-to-upper-middle-class PMC laptop job. It’s also the case that, as I’ve argued for a very long time, the job market is far more volatile than most people believe, and a “safe haven” you choose when you’re 20 years old might not be so safe anymore when you’re 30. But many millions of people are capable of holding down mid-level miscellaneous admin jobs for big corporations. For those of you who are among them, the surest path to being “rich” is to get a college degree, get the best job you can, be willing to switch jobs to get a better salary, and religiously stick money in an index fund that you never touch. If you do that, you can very realistically retire, even retire a little early, with seven figures. You need the discipline to not live beyond your means, and you need to not try and beat the market by being a typical deluded retail investor, but this is all readily achievable for, let’s say, 80% of the population.

The trouble is that a ceiling of, say, a couple million is not what a lot of people think of as rich, and by the time you get that amount you’re like 55 at the youngest, more realistically 60 or 65, and the kind of people who want to get rich want to do so while they’re young. So the plan of making your money by earning a wage from a more-or-less regular job is out.